Table of Content

You must be a member at USAA to apply for a personal loan.. Most of the process with USAA Mortgage can be done through their toll-free number. While USAA Mortgage loans are available online, they aren't customized for customers’ credit score or loan details. USAA isn't quite fully integrated compared to other lenders like Quicken Loans or Rocket Mortgage. Also, to be eligible for a USAA home loan, individuals need a credit score of at least 620. According to Bankrate, in addition to this score, you need to have a debt-to-income ratio of at least 43 percent and a down payment of at least 5 percent.

They give payment deferment if there is a natural disaster. They help you buy your lease if you want to keep it. You can get a specialized loan for cars designed for you if you are disabled.

Credit Education

Fixed-rate loans have a stable interest rate over the life of the loan. An adjustable-rate mortgage has a fixed interest rate for a few years before the rate floats with the market. There are 2 ways to start the application for the USAA VA Home Loan, and chances are you are already logged into your online account. If you’re not logged in yet, click here to get started with finding the purchase rate and different options available to you. If you’re a Guardsman or Reservist and have ever been activated to deployment in a war zone, you’d be able to apply under the active-duty rate. It was early July, and then I tried for the World MC they did lock me out, but I spoke to the CC rep and he said that there would be no issues...

All you’ll need is to be at least 18 years old, have U.S. citizenship or permanent residency, and have enough income to make your payments each month. Integra Credit and 60MonthLoans are two similar options. Read full answerpre-approval tool, which checks with multiple other personal loan providers at the same time. It may help you find a good offer from a lender you weren't originally considering. This process will have no impact on your credit score.

Does USAA do a hard inquiry?

USAA BANK VA Loans Let your military service get you home.. The surviving spouse of a veteran can apply for a home loan under one of these. Term investment grade securities before liquidating higher yielding longer-term securities. Those eligible don’t have to be first-time home buyers. Pre-qualify and receive a personalized rate from lenders that partner with NerdWallet..

This guarantee protects these lenders from default. That is, if a veteran stops paying back his or her VA loan, the government will reimburse a portion of the outstanding loan balance to the lender. While the Department of Veterans Affairs oversees the VA loan program, it doesn’t actually lend money. Instead, a number of VA-approved banks, credit unions, and mortgage companies originate these loans. As such, we’ll use this article to provide an overview of the USAA VA loan.

Key Terms To Know About Personal Loans

This is an estimate of buying power determined from the member’s credit score and an automated underwriting system. While USAA offers conventional loans where the down payment can go as low as 3 percent, the bulk of the loans are VA loans. Usually, VA loans don’t require a down payment.

Supply on the pre-approved automatic call usaa loan. By using a pre-approved automotive bank loan, you can get a distinct picture in the approved bank loan amount. How VA loans work and who is eligible to get one.. VA mortgage lenders offer an assortment of home loans intended to meet different needs.. USAA FSB, $2,088,315,795, 8,945, 11.14%, $233,462. With a pre-approval letter, you're practically viewed as a cash buyer and should command plenty of respect from home.

Can I Refinance My Gm Financial Loan

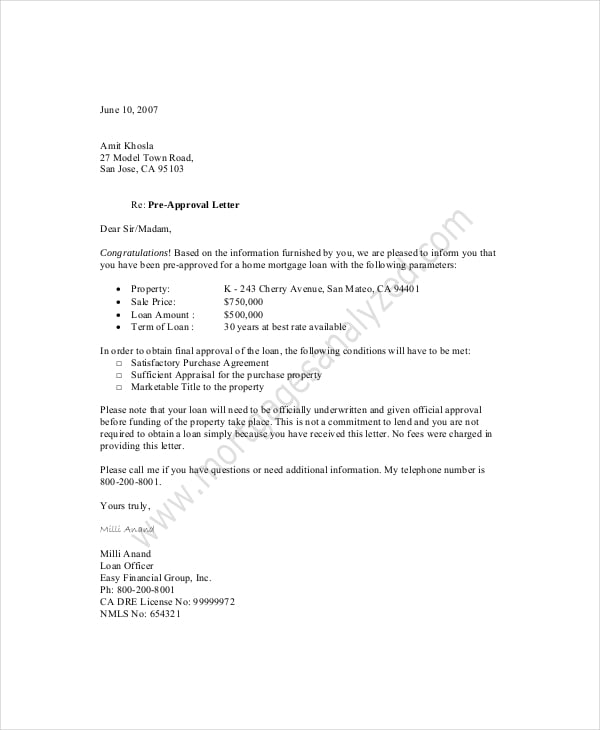

And, this loan volume relates directly to specialization. That is, USAA only offers VA loans (fixed-rate, ARM, and jumbo), meaning its loan officers have intimate understanding of the VA loan process. However, the loans are only available to eligible military members. Only U.S. military members, veterans, their spouses, and children qualify. A mortgage pre-approval is a written statement from a lender that signifies a home-buyers qualification for a specific home loan.

Just know that interest, also called finance charges, will still accrue during this deferral period. If you want a 72-month car loan, USAA requires you to borrow at least $15,000. And for an 84-month loan, youll need to borrow at least $25,000 and buy a vehicle from the model years 2020 to 2022. The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

Each point costs 1% of the overall loan amount that can be either sold to get your closing costs lower or you could buy a point for 1% of the loan amount. Once you figure out what rate you’re qualified for, you should usethe USAA Mortgage Calculator to see how much home you can afford with the expected rates and fees. If you are reading this on your phone and just want to call USAA’s Mortgage Team, here it is. You may have to accept a longer loan term than you had planned a car loan term can be as long as eight years although a shorter auto financing term may be possible. An origination fee is a one-time, upfront fee that some lenders charge for processing a loan. The fee can range from 1% to 10% of the loan amount, and lenders typically deduct it from your loan proceeds.

For Example, if we go through another recession , the banks will be hit harder, and therefore after 5 years, your loan would increase to whatever they wanted. However, if the market is performing better than it was 5 years before, you could receive a lower interest rate. This predicament is also an indication that you might want to look at another house that you can comfortably put the cash down. If you don’t have a healthy cash flow for whatever reason, you should focus on applying for and receiving a VA loan through USAA. Once you sign your loan documents, you have the option to defer payments for up to 60 days.

No refinancing for existing USAA Bank loans, but USAA will help you find the right refinancing option. A paycheck advance is a way to get a portion of your next paycheck from your employer earlier than scheduled. Not all employers offer this service, though.

WalletHub Answers is a free service that helps consumers access financial information. Information on WalletHub Answers is provided “as is” and should not be considered financial, legal or investment advice. WalletHub is not a financial advisor, law firm, “lawyer referral service,” or a substitute for a financial advisor, attorney, or law firm.

If it ran commercials, Capital One Auto Finance might ask, Whats in your garage? To receive pre-approval, youll have to show a monthly income of at least $1,500 to $1,800, depending on your credit history. If your service was between 1957 and 1967, you’ll need to make sure the credits are added to your record at the time you apply. Credit Score Needed First Time Home Buyer Last month, the average.

Flexible loan terms that extend up to 84 months, with no payment due for up to 60 days after your loan is approved . Payday loan is a small, short-term loan that you pay back with your next paycheck. But payday loans are incredibly expensive compared to normal personal loans, so they are not worth pursuing except as a last resort. Overall, USAA offers an outstanding VA loan product and application process. While certainly not the only VA-approved lender, USAA does stand out as one of the better ones. USAA also has a VA jumbo loan, which is for service members looking to finance more than $510,400.

No comments:

Post a Comment